Benefits of Working with hard money lenders in Atlanta Georgia

Benefits of Working with hard money lenders in Atlanta Georgia

Blog Article

Why a Hard Cash Funding Might Be the Right Option for Your Next Investment

Get in tough money car loans, a device that focuses on quick authorization and financing, as well as the home's worth over a customer's debt background. Despite their potential high costs, these lendings could be the key to unlocking your next lucrative deal.

Comprehending the Essentials of Hard Cash Car Loans

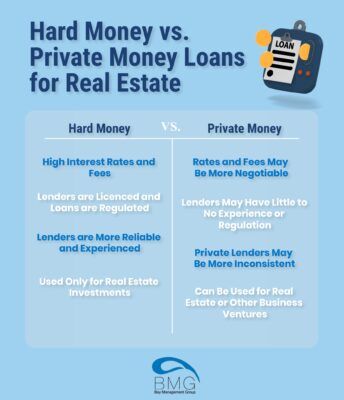

While conventional lendings might be acquainted to most, comprehending the essentials of difficult cash fundings is important for potential financiers. Difficult cash finances are a type of temporary funding where the capitalist protects the Loan with actual estate building as security. Lenders are typically private firms or individuals, making the Loan terms and prices more adaptable than conventional financial institution fundings.

The Advantages of Picking Difficult Cash Car Loans

Possible Disadvantages of Hard Money Loans

Despite the benefits, there are also potential downsides to think about when handling tough cash financings. The most notable is the high rate of interest rates. Since hard cash loan providers handle even more risk with these financings, they typically call for higher returns. This can mean passion rates that are much greater than those of typical finances (hard money lenders in atlanta georgia). Another disadvantage is the short Finance term. Difficult cash fundings are generally temporary car loans, usually around twelve month. This can tax the customer to settle the Finance rapidly. These loans likewise have high costs and closing prices. Customers might need to pay several factors ahead of time, which can add substantially to the total cost of the Finance. These variables can make hard money fundings much less eye-catching for some capitalists.

Real-Life Circumstances: When Tough Money Car Loans Make Sense

Where might hard money lendings be the suitable monetary service? Real estate More hints financiers looking to confiscate a time-sensitive chance might not have the luxury to wait for standard bank lendings.

Right here, the hard money Loan can finance the improvement, boosting the home's worth. Therefore, in real-life circumstances where speed and versatility are crucial, hard money fundings can be the excellent solution (hard money lenders in atlanta georgia).

Tips for Navigating Your First Hard Cash Finance

Exactly how does one efficiently navigate their very first tough money Finance? Guarantee the financial investment home has possible profit adequate to create and cover the Lending earnings. Tough cash fundings are temporary, generally 12 months.

Conclusion

In final thought, tough cash loans provide a fast, adaptable funding alternative for real estate investors wanting to maximize time-sensitive chances. In spite of possible downsides like greater rate of interest rates, their ease of access and focus on residential or commercial property value over creditworthiness make them an eye-catching option. With cautious consideration and sound financial investment approaches, tough cash loans can be an effective device for optimizing returns on temporary projects.

While traditional loans might be familiar to most, recognizing the essentials of tough cash loans is crucial for possible financiers. Hard cash financings are a type of short-term financing where the capitalist protects the Loan with actual estate home as collateral. Lenders are generally personal companies or people, making the Lending terms and prices more adaptable than conventional financial institution car loans. Unlike Check This Out typical bank loans, difficult cash loan providers are mainly worried Our site with the value of the property and its prospective return on financial investment, making the approval procedure less rigid. Hard money financings are usually temporary finances, usually around 12 months.

Report this page